Georgia Jobs Tax Credit

Access a valuable statewide job tax credit available to Eligible Business Enterprises*.

By creating the required number of net new jobs within a tax year, you can enjoy tax savings that offset corporate income tax liabilities. In some cases, payroll withholding tax can also be offset.

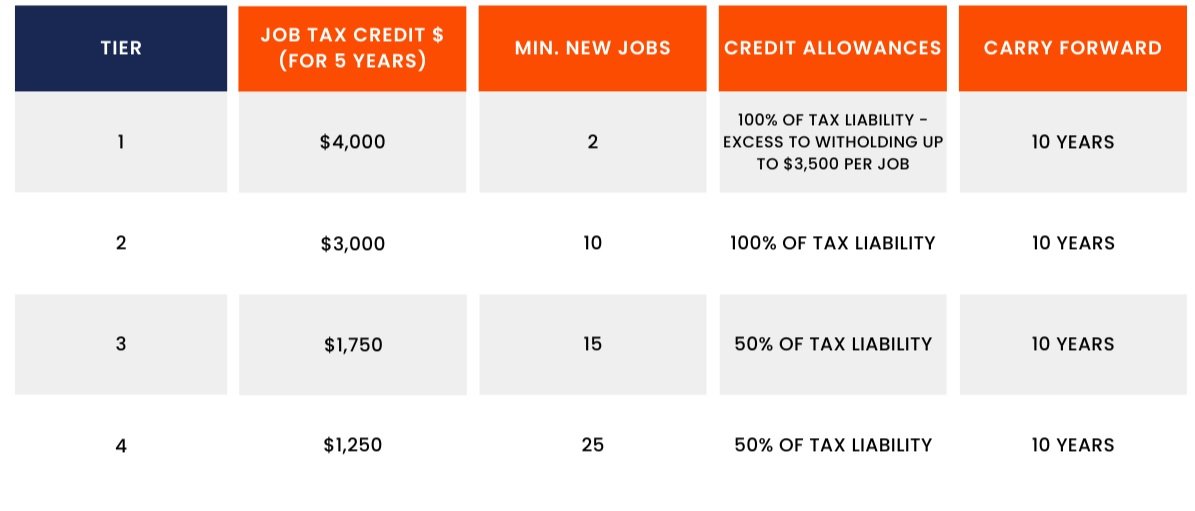

For each new job created and maintained, companies have the potential to earn between $750 and $4,000 per job annually for a period of five years.

The best part is that companies from any industry can qualify for these credits as long as their facilities are located in a Tier 1 - Bottom 40 County, Opportunity Zone, or a Military Zone.

Interested in exploring the Georgia Jobs Tax Credit for your business? Reach out, we're here to help.

Georgia Quality Jobs Tax Credit

Unlock valuable tax credits available statewide to businesses creating 10-50 net new jobs within 12-24 months. Eligible taxpayers can earn up to $5,000 in annual tax savings per new full-time job. These tax savings can offset corporate income tax liabilities, with excess credits applicable to payroll withholding tax.

Taxpayers can earn credits for new jobs created over a 7-year period. If jobs are maintained, credits will continue to be earned annually for 5 years.

Interplay of Georgia Credits

Please note that companies cannot claim both the Job Tax Credit and the Quality Jobs Tax Credit for the same jobs. However, companies are allowed to claim both credits simultaneously. In many cases, the jobs being created will fulfill the requirements for both credits.